- S Strategy

- Multi-Strategy

- Buyout

- VC

- Real Estate

- Private Credit

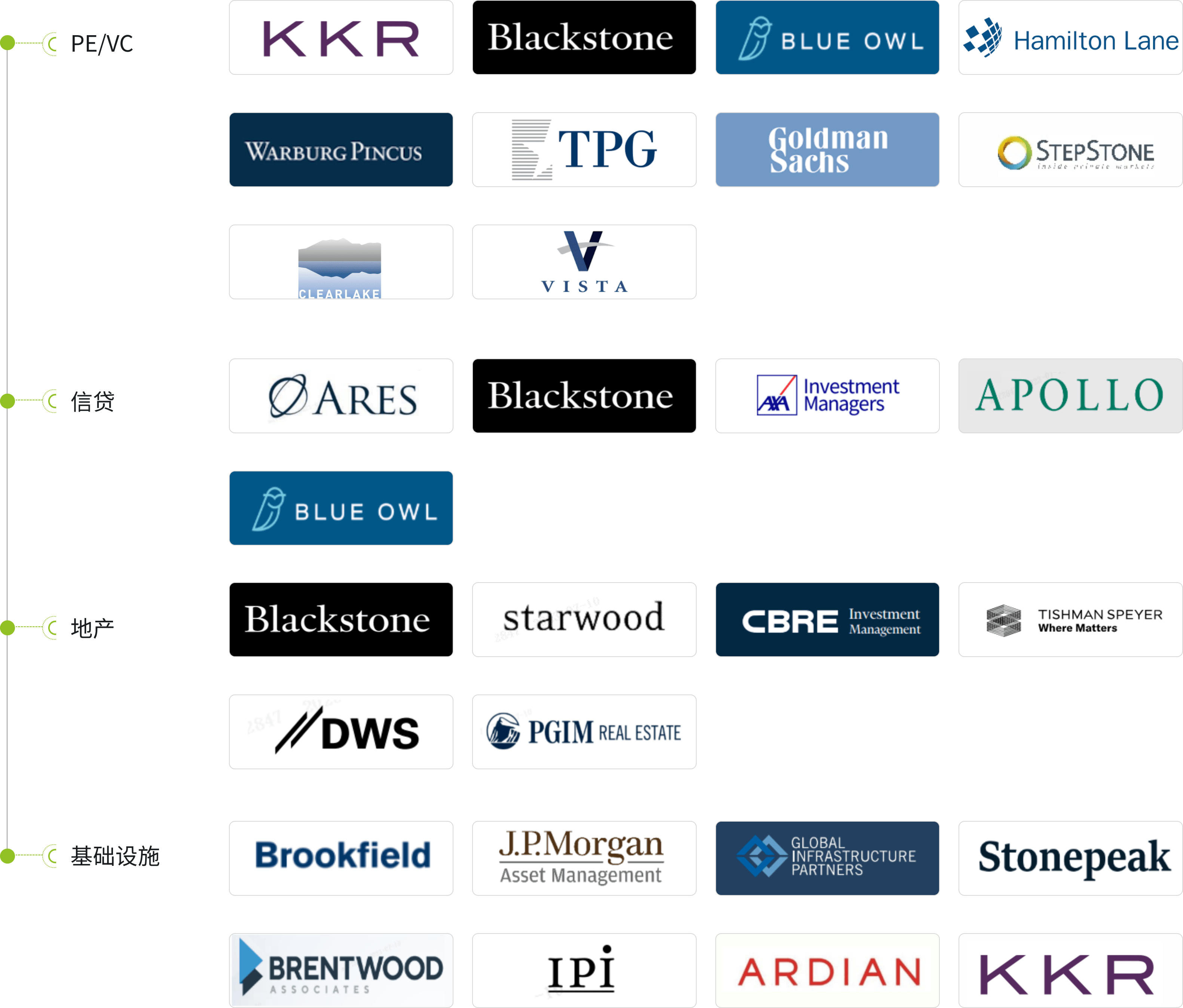

In the current environment where the global private primary market faces exit challenges, S funds have once again become a crucial asset category balancing returns, liquidity, and security. As global S funds continue to mature and improve, transaction structures have become increasingly complex. Olive was one of China's first platforms to enter the S market with institutionalized management, equipped with an experienced S investment team, collaborating with leading global S managers to provide investors with stable income products.

In the current environment where the global private primary market faces exit challenges, S funds have once again become a crucial asset category balancing returns, liquidity, and security. As global S funds continue to mature and improve, transaction structures have become increasingly complex. Olive was one of China's first platforms to enter the S market with institutionalized management, equipped with an experienced S investment team, collaborating with leading global S managers to provide investors with stable income products.

In the current environment where the global private primary market faces exit challenges, S funds have once again become a crucial asset category balancing returns, liquidity, and security. As global S funds continue to mature and improve, transaction structures have become increasingly complex. Olive was one of China's first platforms to enter the S market with institutionalized management, equipped with an experienced S investment team, collaborating with leading global S managers to provide investors with stable income products.

In the current environment where the global private primary market faces exit challenges, S funds have once again become a crucial asset category balancing returns, liquidity, and security. As global S funds continue to mature and improve, transaction structures have become increasingly complex. Olive was one of China's first platforms to enter the S market with institutionalized management, equipped with an experienced S investment team, collaborating with leading global S managers to provide investors with stable income products.

In the current environment where the global private primary market faces exit challenges, S funds have once again become a crucial asset category balancing returns, liquidity, and security. As global S funds continue to mature and improve, transaction structures have become increasingly complex. Olive was one of China's first platforms to enter the S market with institutionalized management, equipped with an experienced S investment team, collaborating with leading global S managers to provide investors with stable income products.

In the current environment where the global private primary market faces exit challenges, S funds have once again become a crucial asset category balancing returns, liquidity, and security. As global S funds continue to mature and improve, transaction structures have become increasingly complex. Olive was one of China's first platforms to enter the S market with institutionalized management, equipped with an experienced S investment team, collaborating with leading global S managers to provide investors with stable income products.

In the current environment where the global private primary market faces exit challenges, S funds have once again become a crucial asset category balancing returns, liquidity, and security. As global S funds continue to mature and improve, transaction structures have become increasingly complex. Olive was one of China's first platforms to enter the S market with institutionalized management, equipped with an experienced S investment team, collaborating with leading global S managers to provide investors with stable income products.